Nike Expansion Research

Research on Nike’s Expansion

Current Situation

The firm that our group has chosen is Nike. Nike was founded in 1964 as Blue Ribbon Sports and was a distributor for the Japanese shoemaker Onitsuka Tiger also known as Asics. In 1971 it officially became Nike Inc. Nike was created by Bill Bowerman and Phil Knight with only $1,200. Phil Knight, was a runner enrolled at the University of Oregon. Originally Knight wanted to call the company “Dimension 6.” Instead they went with Nike which is the Greek goddess of victory. The first Nike shoes were made inside a waffle iron. Bowerman used his wife’s waffle iron in 1971 to make the first Nike shoes. The waffle iron made grooved patterns in the soles to give traction. The shoe was known as the “Nike Waffle Trainer”. The famous Nike swoosh symbol was designed by a student named Carolyn Davidson, for just $35. Nike got its slogan “Just Do It” from a serial killer Gary Gilmore, who said “let’s do it” just before he was executed. Nike signed its first athlete in 1972, a Romanian tennis player llie Nastase. Since then Nike has signed numerous athletes which has greatly helped the success of their company. In 1984 Nike signed Michael Jordan to an endorsement contract and created his signature shoe the Air Jordan. Nike has made millions of dollars from Michael Jordan endorsing their product and this is what propelled their company to new heights. Today Nike is headquartered in Beaverton, Oregon. Nike is the largest brand of shoes, sporting equipment, and clothing and controls more than 60% of the market. Nike has stores all around the world and promotes its products to all ages, gender, and race. They have been growing ever since they started and in 2016 their revenues went up 6 percent to $32.4 billion. Nike products are more than just a pair of shoes or a stylish shirt. To many loyal customers it is a lifestyle and it represents the culture that we live in.

Strategic Posture

Nike is involved in three main industries shoes, sports apparel, and sports equipment. They are leaders in each of these industries but are most successful in the shoe industry. Nike controls 62% of total athletic footwear U.S. brand share. Skechers is second at 5%. Nike leads the industry with $28 billion in annual sales. Nike is very diverse in what types of products they offer. They produce product for all major sports for both male and female. This includes footwear, sports apparel, and sports equipment. They can sell anything from a golf club to a five year old girl to a cross-training shoe for a sixty year old man. Nike sticks to related diversification and stays away from entering new industries that they are not experts in.

Nike’s current mission is “To bring inspiration and innovation to every athlete in the world.” Nike co-founder Bill Bowerman said, “If you have a body, you are an athlete.” The mission was clearly stated on Nike’s website and has no real quantifiable point. Nike’s current business level strategy is broad and differentiated. Nike offers high quality products at a higher price than other brands such as Adidas, Under Armour, and Reebok. Nike practices differentiation because they offer a high cost special product, they have good advertising and spend good money on these advertisements. They also make strong profit because they pass the price along to the customer. They do not need a huge amount of customers but only need a group of loyal customer. Nike has the best of both worlds in regards to their customers. They have a really large customer base and a large percent of these customers are very loyal and will only purchase Nike products. They also have created barriers to prevent new entrants. Nike shoes can be imitated but as long as the shoe has the swoosh symbol, it will be a superior product. Nike has a broad focus because its customer base is very large and diverse. Nike markets to women, men, children, along with different races and ages. Nike can offer expensive products for the wealthier customers but also offer lower priced items. There Nike outlet shops around the world that offer less expensive products for customers that cannot afford regularly priced Nike products. Nike has stores all around the world for customers in different countries. In fact Nike’s largest store is located in London. Some of the most loyal customers of Nike are people from other countries like China and countries in Western Europe. This business level strategy is consistent with Nike’s mission. Nike’s mission was to bring inspiration and innovation to every athlete in the world. Nike is marketing to athletes all around the world and is offering their product to all different types of people like their mission states. Nike’s strategy is appropriate for the environmental context because it has to compete against other shoe companies that are trying to market their shoes the same way but are less successful in doing so. Nike’s revenues and success over the years represents that their business strategy is being followed by management.

How well is Nike performing as compared to other competitors?

The main competitors of Nike include Adidas and Under Armour. The three companies are the biggest retailers that are focused in athletic clothing industry. Each organization has cut out an amazing market share in an apparently persistently developing and improving industry.

Nike is the biggest organization of the three and may be the one with the most brand acknowledgment. Nike has a market capitalization around $102 billion and trailing 12-month deals over $31 billion. Nike finished 2016 valued close $62 per share, which is at the upper end of its 52-week scope of $45 to $68. Its P/E proportion is close to 24, and it yields profits of just around 8%.

Nike is prevailing over the globe; specifically, it keeps up the biggest market share in the athletic attire industry in North America. The organization has endeavored noteworthy endeavors as of late to repair open discernment issues encompassing its work hones in developing markets. Its turnaround in the piece of its business operations has been broadly lauded. Nike markets the majority of its items utilizing the Nickname; however it likewise claims smaller specialty brands, for example, Jordan and Converse.

Nike will likely develop its yearly incomes to $50 billion by 2020. It plans to finish this by fundamentally expanding its immediate deals and web based business incomes in created markets. The organization likewise observes huge development openings in China and in its ladies centered product offerings.

Nike is huge in the business and maybe has the most to lose. Its shares achieved unsurpassed highs in 2016, and its development projections keep on being forceful. Contenders like Under Armor will keep on innovating to endeavor to take market share away, and the more youthful era of purchasers may hint at favoring littler brands and all the more straightforwardly sourced products that they can acquire effortlessly through web based shopping.

Adidas is settled in market portions locally and abroad where it has huge brand devotion in respect to its opposition. Be that as it may, the organization does not brag an incredible same level of top of the line supported competitors, which could hurt its apparent qualities with respect to the next two organizations.

Under Armor will probably be on the assault in years to come. It has paid as much as possible for a lineup of world-class competitors over every single significant game, which ought to keep on feeding its impression of having a portion of the most elevated execution, most-present and inventive attire items. Underarmour has likewise gained a few wellness application organizations, as it looks to coordinate versatile advancements to reinforce its image.

In spite of the organization’s growth, size and development, financial specialists ought to avoid putting resources into Nike for 2017. Nike is a developed organization, and its stock is hitting untouched highs. Those stock costs would appear to mirror its forceful development objectives. In the event that any of those objectives falter, a stock value adjustment is certain to take after.

While Adidas is likewise a developed clothing organization, the estimating for 2017 seems appealing. Its P/E proportion is a great deal more sensible, and it pays a superior profit than Nike. Adidas is probably not going to experience exponential share value development, yet at its present value, it seems, by all accounts, to be a sound speculation for 2017.

Under Armor is an immaculate development play for 2017 and past. Actually, quite a bit of this normal development is proving by its share cost and P/E proportion. Nonetheless, the organization gives off an impression of putting resources into key ranges that will reinforce the brand in years to come. Despite the fact that it would have been extraordinary to be a purchaser quite a long while prior, this stock still has noteworthy more space to keep running up in share cost. (Strider, 2016)

PESTLE analysis of Nike

(1) Political

Expanded free trade policies, government support of the improvement of infrastructure and USA government assistance for modernization is an opportunity for the Nike. However, labor law and health laws of the different countries might p[rove an opportunity and threat at the same time.

(2) Economic

Increase recession affects the purchase on the side of the consumer. Labor demands and downturn in the Asian economy affect the Nike as the primary manufacturer of the product located in Asia. At the same time increase in the raw material prices also affects the Nike.

(3) Social

The increase in the demand for the fitness proves beneficial for the increase sales of the Nike.

(4) Technological

Use of marketing innovation system, segmentation, and commercialization through using online technology enable the Nike to close contact with customers.

(5) Environmental

Environmental changes and increase strategies for gaining sustainability in the changing environment

(6) Legal

Consumer laws, Employment legislation and expansion of health safety regulations.

Porter five forces analysis of NIKE Company

| Threat of New Entrants (weak force) | Bargaining Power of Buyer (Moderate) |

| · High cost of brand recognition and market recognition

· Raising competition from Lululemon Athletica and Under Armor (emerging brands) · Large economies of scale due to outsourcing · Cost of doing business · High Market saturation with big players · Neutral legislation of government · High entry barriers because of large brands |

· Low bargaining power of end customer

· Multiple brand choices · Low switching cost · Multiple Large retailers · Brand image reduce the power of buyers · Low price sensitivity · High dependence upon the brand image and quality · Heterogeneous products |

| Bargaining Power of Suppliers (Neutral) | Threat of Substitutes (weak) |

| · All products of Nike Manufacture in contract factories of China, Indonesia and Vietnam

· High switching cost for finding alternative suppliers · Diverse channels of substitution · Similar products available to supplier with attachment of any brand · Supplier have multiple substitute for the supply of their products · Power of supplier is under the control of brands |

· Counterfeit (fake) products

· High demand for the athlete products · Low standard product of substitute as Nike · Nike has higher quality as compared to substitute · Big size of industry and large opportunities for growth · Buyer preferences for the cheap price products that are without brand image |

| Competitive Rivalry between Existing Players (Intense) | |

| · Direct competitors are Adidas and Reebok, Puma, Umbro, Fila, New Balance, Timberland, Brown Shoe

· Indirect competition from Timberland, Crocs, K-swiss, Sketchers and Non-athletic footwear brands · Loyalty of customers with the existing brands · Low price products, high advertisement and new brand products · Competitors of Nike restore same strategies · Low differentiation between Nike and competitor products · At some extent loyalty of customers with different brand |

The above chart describes the five forces that Nike has to deal with as a brand. The first force among the five forces is the threat of new entrants which is a weak force in our case. Nike’s competitors would need a great deal of financial resource to come up with advertisement and marketing plans to match the stature of Nike as a brand.

Bargaining power of buyer is a moderate force. Nike is an expensive brand which has fixed prices and the bargaining power of the customers I quite low. Having said that, due to their brand name and quality, it still has a great customer base who would buy their products for any price.

Nike controls the bargaining power of its suppliers. The reasons is that they have contract with companies in China, Indonesia and Vietnam to do their supplies. Nike can make a switch of its suppliers any time which empowers Nike’s supplier selection strength.

Nike does not have a real threat to be substituted by another brand. It has a high demand in the athlete community and its quality is the best among its competitors. There are buyers that might chose to purchase a cheap product compared to Nike but that does not pose any real threat to Nike.

Nike faces intense pressure from its direct and indirect competitors in its niche. Adidas, Reebok, Puma, Fila, Timberland and other competitors are coming up with strategies that are focused at improving their quality and utilizing marketing tactics that have the potential to gain market from Nike.

Nike’s Board of Directors

Nike currently has thirteen members in its Board of Directors. The members of the Board of Directors are: Philip Knight, Mark Parker, Elizabeth Comstock, John Connors, Timothy Cook, John Donahoe II, Alan Graf Jr., Travis Knight, John Lechleiter, Michelle Peluso, Jonathan Rodgers, John Thompson Jr., and Phyllis Wise. Philip Knight was one of the co-founders of Nike. He used to be a working CPA accountant at Price Waterhouse and Coopers and Lybrand. He was also an assistant professor of business administration at Portland State University. He serves as a non-voting observer of the board and he does not serve in any additional committees. Mark Parker has worked with Nike since 1979 and during that time his responsibilities involved product research, design and development, marketing, and brand management. Parker is a part of Nike’s executive committee serving as the Chief Executive Officer (CEO) since 2006. Elizabeth Comstock serves as a vice chair at the General Electric Company (GE). Before she went to GE she had also had high positions NBC, CBS, and Turner Broadcasting. Comstock serves on the Compensation Committee and the Finance Committee. John Connors is a partner in Ignition Partners LLC, and has served as a Senior Vice President and Chief Financial Officer of Microsoft Corporation, and is a current Board of Director for Splunk. John Connors serves on the Audit Committee and as the chair of the Finance Committee. Timothy Cook is the lead independent Director of the Board of Directors for Nike. Timothy Cook currently serves as the CEO and Board Member of Apple Inc., and as a Board Member of the National Football Foundation. Timothy Cook is in the Compensation Committee and the Nominating and Corporate Governance Committee. John Donahoe II, served as president and CEO of eBay Inc, and currently serves as Chairman of PayPal Holdings. Donahoe serves on Nike’s Audit Committee, Finance Committee, and Nominating and Corporate Governance Committee. Alan Graf is the Chief Financial Officer and Executive Vice President of FedEx Corporation. He serves as the Chair of the Audit Committee and a member of the Nominating and Corporate Governance Committee. Travis Knight is the President and CEO of LAIKA, LLC. He serves on the Corporate Responsibility and Sustainability Committee and the Executive Committee. John Lechleiter served as the President and CEO of Lilly and company until retiring in December of 2016. He serves on the Compensation Committee, the Finance Committee, and the Nominating and Corporate Governance Committee as the chair. Michelle Peluso is the Chief Marketing Officer of IBM and served as the CEO of Gilt, an online shopping destination, until its sale to Hudson Bay Company. She serves on the audit committee and the Corporate Responsibility Committee. Johnathan Rodgers is a retired broadcast and cable television executive who has worked as an executive for stations such as Discovery and CBS in different executive positions. He serves on the Corporate Responsibility and Sustainability Committee and the Compensation Committee. John Thompson worked as a men’s basketball coach for Georgetown University and the United States Olympic basketball team of 1998. He also worked as a sports radio talk show host and as a sports analyst for Turner Network Television. He serves on the Corporate Responsibility and Sustainability Committee. Phyllis Wise has worked as a professor for many institutions such as the University of Maryland and the University of Illinois. During her tenure at the University of Washington, she lead the creation of the College of the Environment whose objective is to develop solutions to develop a sustainable environment through research and teaching. She serves on the corporate Responsibility and Sustainability Committee as the chair, and the Nominating and Corporate Governance Committee.

Marketing

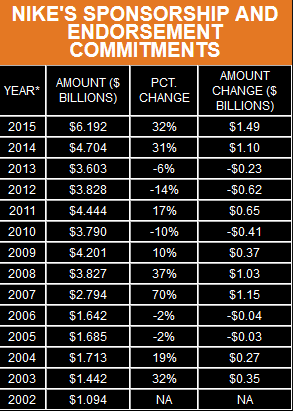

Nike is the most popular shoe and sports apparel brand in the world. Much of their success comes from their great marketing strategies. Nike uses many different marketing strategies which include commercials, endorsements, social media, and word of mouth. Nike endorses hundreds of athletes from all the major sports. This graph from sportsbusinessdaily.com shows how much Nike has spent in endorsements and sponsorships since 2002.

Nike endorses some of the world’s most recognizable athletes such as Lebron James, Kevin Durant, Derek Jeter, Michael Jordan, and Cristiano Ronaldo. Another way Nike markets is through commercials. Nike has had some classic commercials in past years. These include the first “Just Do It” commercial, the Michael Jordan and Spike Lee commercial, and the “Bo Knows” commercial. Nike since then has moved away from those types of advertisements and have moved towards emotional branding. According to ramnathjk.com emotional branding appeals to a customer’s needs, aspirations, or emotional state in order to build a particular brand. Nike uses the story of the hero in their commercials to give the consumer a feeling of attachment to the product. Instead of using an external enemy, Nike uses an internal foe such as laziness to motivate their consumers. As social media continues to grow and become more important to businesses, Nike has had to adapt and use this as a marketing strategy. Nike uses social media to interact with their customers and to create relationships. Nike uses multiple social media platforms such as Twitter, Instagram, Facebook, Pinterest, and Google+. Nike has multiple Twitter accounts so they can answer any questions that consumers may have. Instagram is Nike’s most popular account with 13.2 million followers.

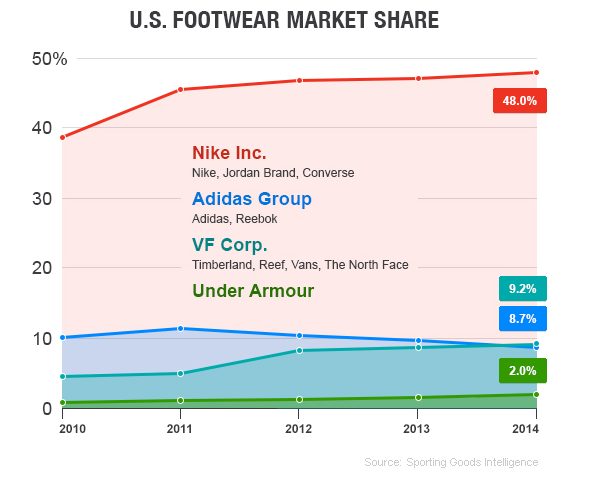

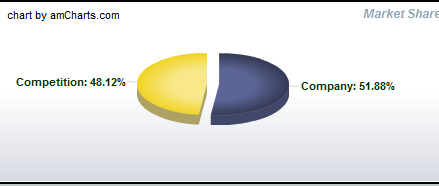

Nike is definitely maximizing their market share and below is a chart that shows Nike’s market share compared to the industry.

As the chart from fortune.com shows Nike has owned the majority of the U.S. footwear market share from 2010 to 2014. Below is another graph from csimarket.com that shows the footwear segment market share of Q1 2017.

Nike is performing very well in terms of their market position and marketing mix. Nike is the best performing firm in athletic footwear and athletic apparel. Nike’s product mix include shoes, apparel, and equipment. Nike offers different types of shoes such as basketball, baseball, running, tennis, football, soccer, and many other types. Compared to Under Armour, Nike offers are much larger variety of shoes. Under Armour mainly offers basketball, football, baseball, soccer, and running shoes. Nike also offers equipment for each sport that outnumbers the products produced by Under Armour. Under armour does compete with Nike in apparel. Under Armour offers quality sports apparel and created the material that is now used in many of today’s sportswear. This material keeps athletes warm, dry, and light in cold conditions, and comfortable in warm conditions. Nike has had to compete with this design and has tried to imitate their material with a dri fit product. When it comes to pricing Nike uses the value-based pricing strategy. Nike sales and profits continue to grow through this pricing strategy. Nike uses this to see how much the customers are willing to pay. Nike continues to slowly increase prices to increase sales and profits. Under Armour also uses a value-based strategy and have competitive prices. Nike and Under Armour apparel are close in prices but Under Armour shoes on average are cheaper than Nike shoes. Nike sells its products all around the world through retailers, online stores, and retail outlets. Most of Nike sales come from the countless retailer stores throughout the world. Under Armour also sells their products through retailer, online stores, and retail outlets. Nike utilizes selling through online stores better than Under Armour which gives them an advantage. Promotion is a big factor in Nike’s business. Nike uses advertising, personal selling, direct marketing, sales promotions, and public relations to promote their brand.

Nike’s greatest promotional tactic is advertising through endorsements, commercials, and social media. As stated earlier Nike spends billions of dollars each year in advertising. These advertisements clearly payoff because Nike continues to spend more and more on advertising each year. The more Nike has spent on advertising throughout the years the more their market share has increased. Under Armour also uses the five elements of the promotional mix. Under Armour does not come close to spending as much as Nike on advertising but is increasing their marketing spending each year.

In conclusion marketing is a big strength for Nike. From analysing Nike’s past performance it seems they are going to continue to trend upward. Nike’s main strengths are promotion and product. Nike offers a high quality product and are able to promote through a variety of ways. Nike can sometimes have high prices but if the customers are continually willing to pay for the product the pricing strategy does not need to be changed. Overall Nike has a very strong marketing mix which provides the company great success.

Operations/Production

Nike has made improvements in its productivity through strategic locations of production facilities, establishing better policies within the Human Resources department and using product differentiation as their competitive strategy. Within production, Nike has had to combat ever-changing fashion trends and slowing sales of older styles. They are looking to international markets to increase profitability and boosting sales through capitalizing on internet sales opportunities. This marketing research will help the company determine which products they should put more money into improving and how they should market them in order to be the most profitable. The strategic placement of production facilities was a good use of financial resources as well because they are close to raw materials and cheaper sources of labor markets. Although there is a higher cost for transporting the products to the areas of distribution, as Nike continues to expand its market internationally, these costs will go down as more products will be shipped closer to production facilities and the increase in profits from more markets will also help offset the transportation costs.

They have decided to put more money into developing their apparel department because of the potential profitability. The money is going towards research and development of higher end clothing and increases their market share in the middle and low end prices. Capital spending has also focused on marketing research to maintain presence as one of the high-end and well respected brands in the athletic wear industry. This marketing research will help the company determine which products they should put more money into improving and how they should market them in order to be the most profitable. Nike has also been working hard to improve its Human Resource department after much bad publicity with labor practices. When the HR department is improved, it will help the overall company morale and make the brand look better as a whole, which will help with sales.

Nike has done well managing their debt-to-total-assets ratio, at 15.36% which is far below the industry average at around 40%. They use less debt financing to finance their firm operations as compared to competitors in the industry. Because they are highly liquid, they are able to increase debt financing in case they would want to increase research or acquire additional capital. Costs of productions have been kept about the same, with an increase in technology and efficiency while prices rise overall within the economy. They are also trying to save money by developing an internal monetary trading system, to avoid losses on currency movement. Nike has done well in international markets compared to their competitors, but still does well in the U.S. and has a chance to improve profits in the US market as the US economy is growing. However, they have to be aware of the possible threat of economic downturns and consumer preferences effecting sales of higher priced products and leaving the company with excess inventory. Nike needs to continue to launch innovative products that customers want while maintain a balance between the quantity they produce and the demand from consumers in order to stay profitable.

As discussed earlier, Nike has invested in their research and development for newer, high end products to maintain dominance of the market. This has proved to pay off in the past as they have stayed ahead of their competitors, such as Under Amour, Reebox and Addidas because they have continued to deliver high quality products and introduced them when the market demanded them. The firm is definitely technologically competent, as they have always been a leader in the development of their products and strategic marketing and sales through technology. Their research and development has helped create some of the best athletic shoes on the market with the use of new technology. They have also used technology in their operating systems. With upgraded software, the firm is able to analyze sales and inventory data much more quickly, which can help with making marketing and production decisions. These technological improvements will continue to be made in order for management to stay on top of analysis. Compared to other firms, Nike has done very well with their investment as they have a lot of positive ratios, with a 30% market share for example.

In conclusion of analyzing the operations and production departments of Nike, there are many reasons why Nike has been such a successful company and market leader, but still has areas that they can improve upon. Below is a decision matrix, which analyzes the business strengths and weaknesses of the organization and then ranks them as being high or low in market attractiveness or relevancy. Those that are both high in business strengths and market attractiveness are the reason Nike has done so well. To better the company, Nike needs to look at improving those that are low in business strengths, and especially those that are low in business strength and high in market attractiveness.

Decision Matrix

| Business Strength

Market Attractiveness |

High | Medium | Low |

| High | Performance/

Presentation |

Marketing | Human Capital |

| Medium | Market Share | Corporate Culture | Pricing |

| Low | Leadership | Communication | Motivation |

Although there are a lot of factors within the operations and production of Nike products, these were some of the most important ones that can be analyzed. Nike has always done well with the performance and presentation of their products, as well as the marketing of those products, so those are both strengths that have a large impact on market decisions. Because Nike is usually on the more expensive side, pricing was placed on the lower end of strengths, and only medium for market attractiveness because consumers continue to buy their products even if they believe they are overpriced. Market share for the company is one of their biggest strengths, as they dominate most of the market in athletic clothing. Leadership, communication and corporate culture all were high to medium strengths as the company has done very well in keeping its management happy and working well together, but was ranked low and medium on market attractiveness only because most of the public does not experience the culture of the company. Motivation and Human Capital were ranked as weaknesses as there has been an increase in turnover in employees and less motivation to keep them around. Human Capital is ranked as high in market attractiveness because there was backlash from consumers when they discovered that labor laws were not being followed for employees in foreign countries. This is something that Nike has definitely taken notice of and has tried to improve upon recently to gain back public support of their brand and increase sales.

What is the cost of capital for Nike? What impact this would have on competitiveness?

The cost of capital is known as the rate of return required by a capital supplier in return for previous an interest in another venture or business with comparative hazard. WACC is the normal of the costs of these wellsprings of financing, each of which is weighted by its individual use in the given circumstance.

Since WACC is the base return required by capital suppliers, chiefs ought to invest just in ventures that generate returns in overabundance of WACC. The WACC is set by the financial specialists (or markets), not by administrators. In this manner, we can’t watch the genuine WACC, we can just gauge it. The WACC condition is the cost of every capital part multiplying by its corresponding weight and after that adding.

Where;

Rd = cost of debt t = tax rate Re = equity cost

E = market value of equity of the firm D = book value of the debt of the firm

The yield to maturity (YTM) is the known as internal rate of return (IRR, general loan cost) received by a financial specialist who purchases the security today at the market cost, expecting the security will be held until development and that all coupon and key installments will be made on calendar. Respect development is the rebate rate at which the entirety of all future money streams from the security (coupons and main) is equivalent to the cost of the security.

Cost of capital (CAPM)

Capital asset pricing model (CAPM) demonstrates what ought to be the normal or required rate of return on hazardous resources like Nike’s basic stock. (nike, 2017)

Rates of Return

Efficient Risk (β) Estimation

Expected Rate of Return

Calculations

1 CovarianceNKE, S&P 500 ÷ (Standard DeviationNKE × Standard DeviationS&P 500)

= 12.94 ÷ (11.79 × 3.51)

2 CovarianceNKE, S&P 500 ÷ VarianceS&P 500

= 12.94 ÷ 14.02

3 AverageNKE – βNKE × AverageS&P 500

= 2.57 – 0.92 × 1.47

Projected Rate of Return

3 E(RNKE) = RF + βNKE [E(RM) – RF]

= 3.05% + 0.92 [13.46% – 3.05%]

= 12.59%

Comments on cost of equity

The expected rate of return for the next 20 years is very feasible for the investors and management to invest in the Nike. The risk for the company is too low and the profits are increasing so the company is expected to pay a dividend.

Critical Success factors

Nike’s mission is to bring inspiration and innovation to every athlete in the world, and anyone with a body is an athlete. In order to accomplish this mission, Nike needs to keep innovating and bringing new products to the public. We can see evidence that Nike has been doing just that by looking at their website and viewing their upcoming products. Another thing that Nike needs to do to is keep it’s brand image strong. With the rise of Nike’s competitors Under Armour and Adidas, Nike needs to make sure that it keeps its’ reputation as the top sports retailer or the competition will take that title and customers away from them.

Strategic Problem

Nike faces two main problems which can impede the company’s success in the long run. The first problem is Nike’s issues with excess inventory. In 2016 this excess inventory has caused Nike’s gross margins to decline by 30 basis points. Nike is known for their innovation and creativity which is a positive but also contributes to their inventory problem. Nike is constantly bringing in new products but there is not enough time for them to be sold. Many of Nike’s products are not being sold and are kept in inventory. Price reductions are then applied so that the products can be sold. This is hurting Nike and can continue to become a problem if nothing is done. The other problem Nike faces is the growing competition of other companies. The main company giving Nike competition is Under Armour. Under Armour is becoming more of a threat to Nike and is continuing to grow. Under Armour is very successful in the apparel segment and is improving in the footwear segment. In the past two years Under Armour has grown in the 30% range year over year. Endorsement deals with athletes like Steph Curry, Bryce Harper, and Tom Brady has helped Under Armour’s sales and notoriety. In fact Steph Curry’s shoe sold better than the Air Jordan’s and Lebron’s helping net revenue from footwear to grow 58% year-over-year. Under Armour is mainly only a factor in the U.S. but plans to expand internationally to compete with Nike. They expect to double their stores in China and are pursuing sponsorships with multiple soccer teams overseas. The growth of Under Armour and other companies like Adidas can cause Nike more problems in the future.

Recommendation

Nike has had a history of being successful in choosing the right generic strategies to be keep their company competitive. A generic strategy shows how a business achieves and maintains a competitive edge in the market. Nike has used both Cost Leadership Strategies and Differentiation Strategies to keep a competitive advantage. By using a cost leadership strategy, they have stayed ahead of customers financially by cost savings. They have minimized production costs by strategically placing manufacturing sites, using cheaper labor forces, and using technologically advanced materials and machines that save time and energy in production. By saving money in production, they are able to maximize profits and even reduce costs to customers so that they can receive more of the market. The differentiation strategy sets Nike apart because they offer such unique and innovative products. Through research and development, they make sure that they offer products that the market is looking for and introduce them before their competitors do. They will be able to continue to increase their products by offering new products, and in the correct quantity in the right areas, at the right times.

As far as recommendations, Nike should stick to the Differentiation Strategy to keep their company the most competitive. Although the Cost Leadership Strategy has proved to help Nike be successful, they are at risk of losing money if they lower their prices too much or lower production costs at the expense of quality of their products. With the differentiation strategy, they can continue to be aware of keeping costs low but focus on what consumers in the market want and what they will buy to make them the most profitable.

Implementation

The strategy that we would recommend Nike to implement, is to continue to use their innovation and product development to differentiate themselves from their competition. The thing that Nike does best is bringing innovation into their products. Nike should keep doing what it’s doing and put more of its’ research and development into the apparel segment in order to compete with Under Amour. By doing this, not only will Nike be taking back its’ clients back, but it will also help with the inventory problem by reducing the amount of shoe releases that Nike does. They also need to effectively use their endorsements and bring in new up incoming athletes to bring attention to their various products and create a demand for them. In order to do this, management will need to pay more attention to the apparel side of the business, marketing expenses will be increased due to the extra commercials and endorsements, operations will shift toward the apparel segment, and the finance structure may change if Nike takes out loans or issues new stock to fund the additional research and development. If Nike succeeds in utilizing this strategy, then in the first year after the shift, you may see a decrease in Nike’s net income due to the increase in marketing expense, but after that there will be an increase in Nike’s net income due to not having to sell large amounts of inventory at discounted prices and increasing sales in their apparel lines. If Nike focuses on the apparel side of sports merchandise, then they will be able to fight back against the competition.

Bibliography

nike. (2017) Stock Anslysis on net Capital asset pricing model [Online]. Available from: https://www.stock-analysis-on.net/NYSE/Company/Nike-Inc/DCF/CAPM#Expected-Rate-of-Return [Accessed march 2017].

Strider, J. (2016) Adidas Vs. Nike Vs. Under Armour: Which for 2016? (NKE,UA).

“BRING INSPIRATION ANDINNOVATION TO EVERYATHLETE* IN THE WORLD.” About Nike – The Official Corporate Website for NIKE, Inc. and Its Affiliate Brands. N.p., n.d. Web. 31 Mar. 2017.

“NIKE, Inc. Reports Fiscal 2016 Fourth Quarter and Full Year Results.” Nike News. N.p., n.d. Web. 31 Mar. 2017.